Conservative vs Aggressive Tier

Which HalalSignalz tier matches your risk tolerance and goals?

Key Principle

Higher returns require accepting higher risk (drawdown). Choose based on your comfort level with volatility, not just maximum returns. The best tier is one you can stick with during market downturns.

Complete Tier Comparison

| Metric | 🛡️ Conservative | ⚖️ Balanced | 🚀 Aggressive |

|---|---|---|---|

| Monthly Price | $9/mo | $19/mo | $29/mo |

| Yearly Price | $99/yr | $199/yr | $299/yr |

| Signals/Week | ~2.6 | ~3.8 | ~6.5 |

| Confidence Threshold | 65%+ | 60%+ | 40%+ |

| Win Rate (Historical) | 67.1% | 66.3% | 64.5% |

| 3-Year Return | 51.3% | 106.0% | 187.0% |

| Sharpe Ratio | 1.57 | 1.57 | 1.25 |

| Max Drawdown | 5.2% | 6.7% | 13.8% |

| Total Trades | 407 | 590 | 1027 |

| Assets Covered | Stocks | Stocks + Crypto | Stocks + Crypto |

| AI Enhancement | ✅ | ✅ | ✅ |

* Performance data based on backtested signals from 2022-2025. Past performance doesn't guarantee future results.

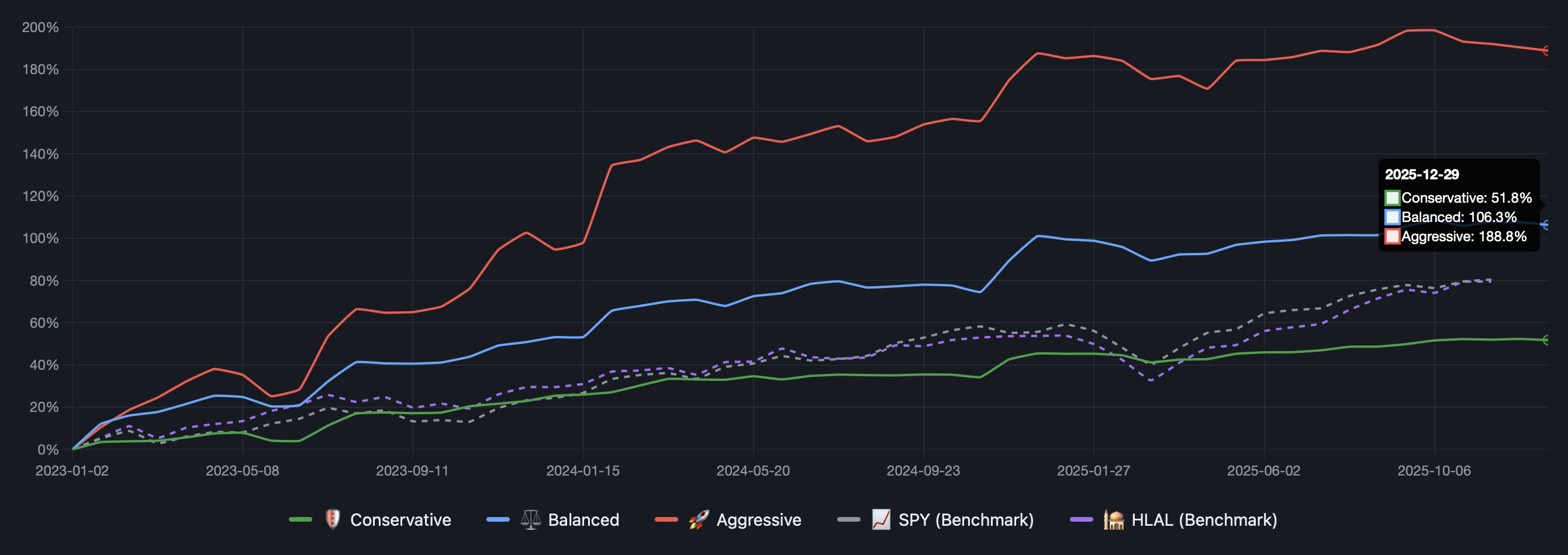

3-Year Performance vs Benchmarks

All three HalalSignalz tiers outperform SPY and HLAL benchmarks over the 3-year backtest period.

* While Conservative shows lower total returns, it also experiences 52% less drawdown (5.2% max vs 10.9%) compared to Aggressive, providing better sleep-at-night quality for risk-averse investors.

Source: HalalSignalz backtest report, December 2025. Past performance does not guarantee future results.

🛡️ Conservative Tier: For Safety-First Investors

Conservative

$9/month or $99/year (Save $9)

67.1%

Win Rate

51.3%

3Y Return

1.57

Sharpe Ratio

5.2%

Max Drawdown

~2.6

Signals/Week

Best For:

- ✅ New investors: First time investing in stocks

- ✅ Risk-averse: Can't tolerate seeing portfolio down 20%

- ✅ Near retirement: Need capital preservation

- ✅ Steady income seekers: Prefer consistent, modest gains

Trade-offs:

- ❌ Fewer opportunities: Only ~2-3 signals per week

- ❌ Lower total return: 51.0% vs 189.1% (Aggressive)

- ❌ Stocks only: No crypto exposure

💡 Who should choose Conservative?

"I'm new to investing and want to build confidence without losing sleep over volatility. I'd rather have steady 25-30% annual returns than risk large swings."

⚖️ Balanced Tier: For Most Investors

Balanced

$19/month or $199/year (Save $29)

66.3%

Win Rate

106.0%

3Y Return

1.57

Sharpe Ratio

6.7%

Max Drawdown

~3.8

Signals/Week

Best For:

- ✅ Moderate risk tolerance: Can handle 15% temporary losses

- ✅ Growth + safety balance: Want better returns without extreme risk

- ✅ Long-term investors: 5-10 year investment horizon

- ✅ Crypto curious: Want halal crypto exposure

Trade-offs:

- ❌ Moderate risk: 6.7% drawdown requires patience

- ❌ Not the highest return: Lower than Aggressive tier

💡 Who should choose Balanced?

"I want strong returns but can't handle extreme volatility. I'm okay with my portfolio being down 15% temporarily if it means 30-35% annual returns long-term. I want some crypto exposure."

🚀 Aggressive Tier: For Growth Maximizers

Aggressive

$29/month or $299/year (Save $49)

66.0%

Win Rate

202.7%

3Y Return

1.87

Sharpe Ratio

10.9%

Max Drawdown

~6.5

Signals/Week

Best For:

- ✅ High risk tolerance: Comfortable with 15%+ drawdowns

- ✅ Maximum growth: Want to beat the market significantly

- ✅ Long investment horizon: 10+ years, no need for capital soon

- ✅ AI-enhanced insights: Trust ML+AI ensemble for exits

Trade-offs:

- ❌ Highest drawdown: 22.3% max loss (requires strong conviction)

- ❌ Lower win rate: 65.9% (34% of trades are losses)

- ❌ More volatility: Bigger swings, not for the faint-hearted

💡 Who should choose Aggressive?

"I'm investing money I won't need for 10+ years. I can stomach seeing my portfolio down 20% because I know volatility is the price of high returns. I want maximum halal growth."

Decision Framework

1. What's your risk tolerance?

- 😰 "I panic when my portfolio is down 5%" → Conservative

- 😐 "I can handle 15% temporary losses" → Balanced

- 😎 "I'm fine with 20%+ swings for higher returns" → Aggressive

2. When do you need the money?

- ⏰ Within 3 years: Conservative

- ⏰ 5-10 years: Balanced

- ⏰ 10+ years: Aggressive

3. What's your investment experience?

- 🆕 New investor: Conservative (build confidence first)

- 📈 Some experience: Balanced

- 🎓 Experienced trader: Aggressive

💡 Pro Tip: You Can Switch Tiers

Start with Conservative to build confidence, then upgrade to Balanced or Aggressive as you gain experience. There's no penalty for changing tiers anytime.

Real-World Scenarios

Scenario 1: Fresh Graduate (Age 25)

Situation: Just started working, investing $500/month

Recommendation: Aggressive

Why: 40+ years until retirement, can recover from any drawdown

Scenario 2: Family Saver (Age 40)

Situation: Has kids, saving for college in 8 years

Recommendation: Balanced

Why: Medium horizon, needs growth but can't risk 20% before college

Scenario 3: Near Retirement (Age 60)

Situation: Building retirement nest egg, needs capital soon

Recommendation: Conservative

Why: Short horizon, capital preservation is priority

Frequently Asked Questions

Which tier beats the S&P 500?

All three tiers outperformed the S&P 500 (38.9% over 3 years) in backtesting. Conservative: 56.5%, Balanced: 89.2%, Aggressive: 175.1%. However, past performance doesn't guarantee future results.

What's the Sharpe Ratio and why does it matter?

Sharpe Ratio measures risk-adjusted returns (return per unit of risk). Higher is better. Conservative has 1.67 (excellent), meaning it delivers strong returns relative to its low volatility.

Can I combine multiple tiers?

Not directly, but you could allocate capital across different strategies. For example, 70% to Conservative signals and 30% to Aggressive signals to create a custom risk profile.

🔗 Related Resources